Last Wednesday, City of Chico Finance Committee listened the city’s $91,000 consultant lay out their tax measure campaign. First, the private meetings with stakeholders (they listed Enloe, the Farm Bureau, and the Chamber of Commerce). Next, a mailer with a survey. Finally, they will craft a series of videos to spread out on social media, telling us what they think we want to hear, based on answers to the survey.

The city needs to spend whatever taxpayer money on this venture that they can before they actually submit their ballot to the county clerk in June. Once the ballot is given a letter designation by the county clerk, the city is no longer allowed to spend taxpayer money. The plan you see above will cost at least $91,000 of our money, money that should be going to infrastructure and services.

This should all be familiar to you – this was the same strategy used to Chico Area Recreation District consultants when they rolled out the ill-fated Measure A in March 2020. CARD consultants used the same game plan – early mailers to get people thinking positive about CARD, then a survey, then videos and more mailers based on what they thought they found out from the surveys.

They decided to do a phone survey toward the end – that’s the easiest way to lead people to the conclusion you want, if they bother to pick up, that is. I remember the CARD consultant discussed the difficulties of phone surveys, starting with the reluctance people have to answer an unfamiliar number. They’d get around that, she said, by using a local number to do the calling – from Oakland. They still gathered responses from less than 1% of the local population, and the questions were heavily led, with a prompter on the other end of the phone to “interpret” the responses.

Measure A, which cost the district over $100,000 still failed, with only 47% of participating voters willing to support it. CARD staff and board all lamented the decision to make it a 2/3’s measure, but you see there, they couldn’t even get a full 51% of the voters to support it.

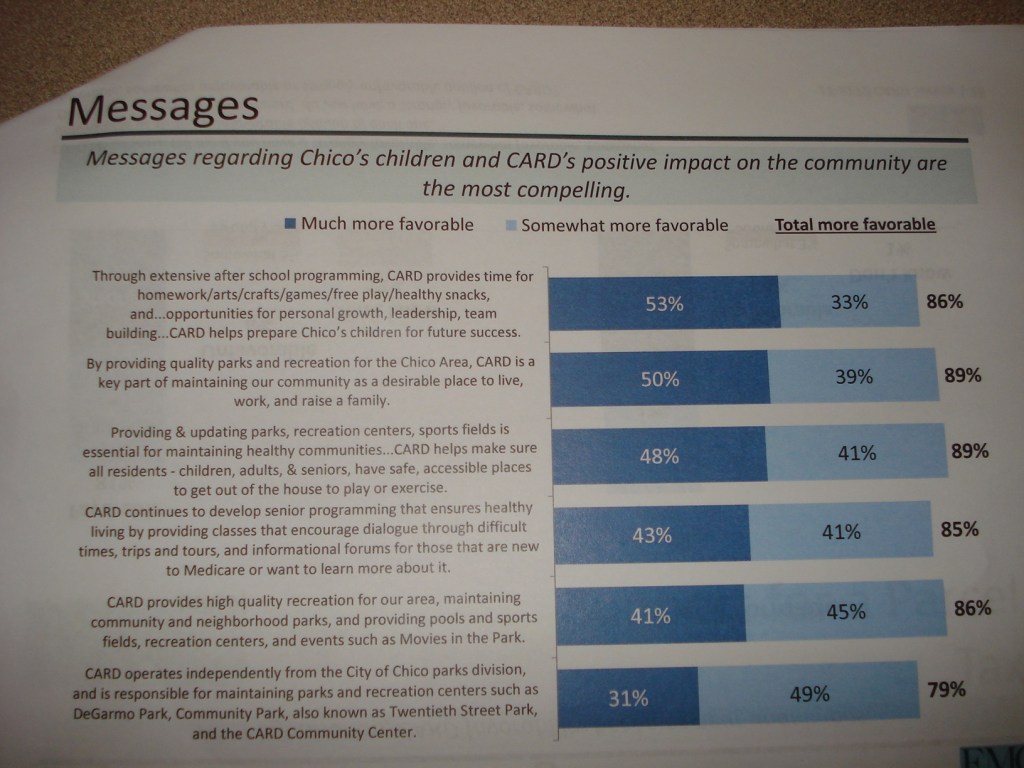

The board had been misled by the consultants as to the results of the survey. The consultants interpreted huge support in the community. This is how they use these surveys – here they are discussing the effectiveness of different arguments used in convincing respondents to pass this dud.

CARD did several surveys over the years leading up to Measure A. Each time, the consultant reported a positive, supportive response from the public. Come on, that’s how they make their money. The consultants that said it wouldn’t pass were never invited back, I sat through that for several years. While the board spent money on a conga-line of consultants, studies, surveys and mailers, they closed Shapiro Pool due to lack of maintenance and made the community hold fundraisers to fix their skateboard park.

We could still nip this in the bud if we just pushed back hard enough. First of all, don’t participate in any survey. They will turn your participation into “support” for the measure, and council will go forward based on that advice. Instead, contact the council NOW and let them know you will NOT support this sales tax increase. Tell them how much your utility bills have gone up over the past few years, tell them how much groceries have gone up. Tell them how disappointed you are in their “leadership” and their spending priorities. Tell them you’re tired of paying the lion’s share of Staff benefits.

The consultant predicted push back. “We’ll get a lot of cranky folks. But we’ll get folks who think this has been done out in the open…” I love that. If you question this little scam, you’re just “cranky“. Wow, interesting choice of words Mr. Sheister – “folks who think this has been done out in the open…” That’s what they have to convince people of, that this whole thing is all sunshine and lollipops and done for the good of the taxpayers. That’s the line of bullshit they’re casting out across Chico, don’t bite on it.